Title

Create new category

Edit page index title

Edit category

Edit link

UK Banks

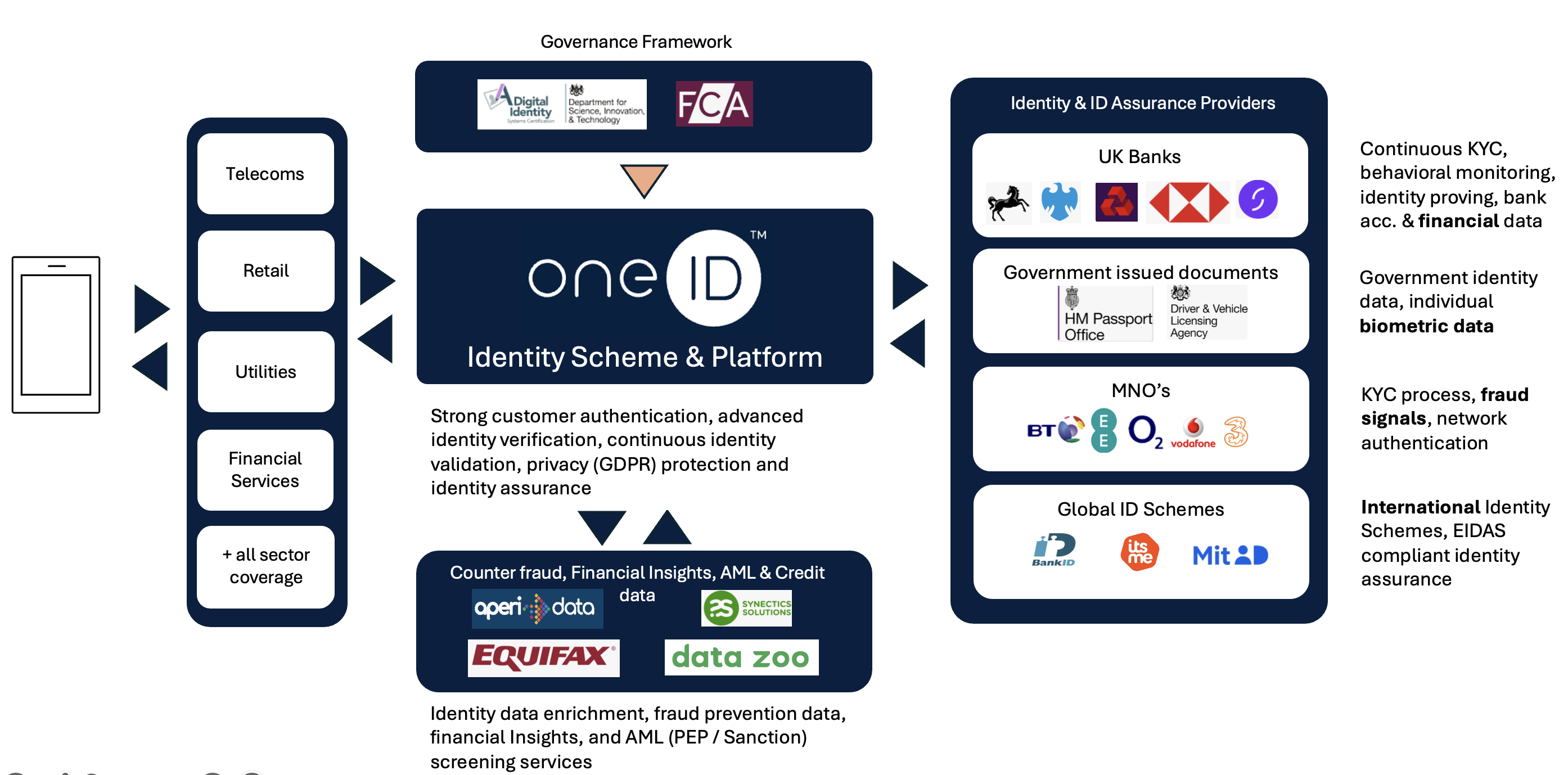

OneID® enables companies to authenticate a consumer's identity using information held by their bank. This document provides an overview of the underlying technology, offering an introduction to the more detailed documentation for specific components of the system.

It assumes the reader has seen a demonstration of OneID® and is familiar with the typical user experience. For a demonstration video, visit OneID's website.

Service Summary

OneID® is an identity verification service that works in collaboration with participating banks (the "Identity Providers" or "IDPs"). The service is designed for organizations ("Relying Parties" or "RPs") that require identity verification for consumers accessing online services. OneID® can be integrated into the verification process, leveraging the trusted position of banks in consumers' lives to provide high-quality, verified identity data.

Key Benefits:

- Faster & Easier Consumer Experience: Simplifies identity verification, requiring less data input from users, leading to higher sign-up conversion rates.

- Secure & Digital: Real-time, bank-verified data ensures a highly secure and fully digital identity service.

- Fraud Prevention: Strong Customer Authentication (SCA) through banks guarantees that the identity owner is present during the transaction, reducing fraud risk.

- Cost-Efficiency: Reduces the cost of identity verification processes for organizations.

This schematic gives a high-level view of our platform capabilities:

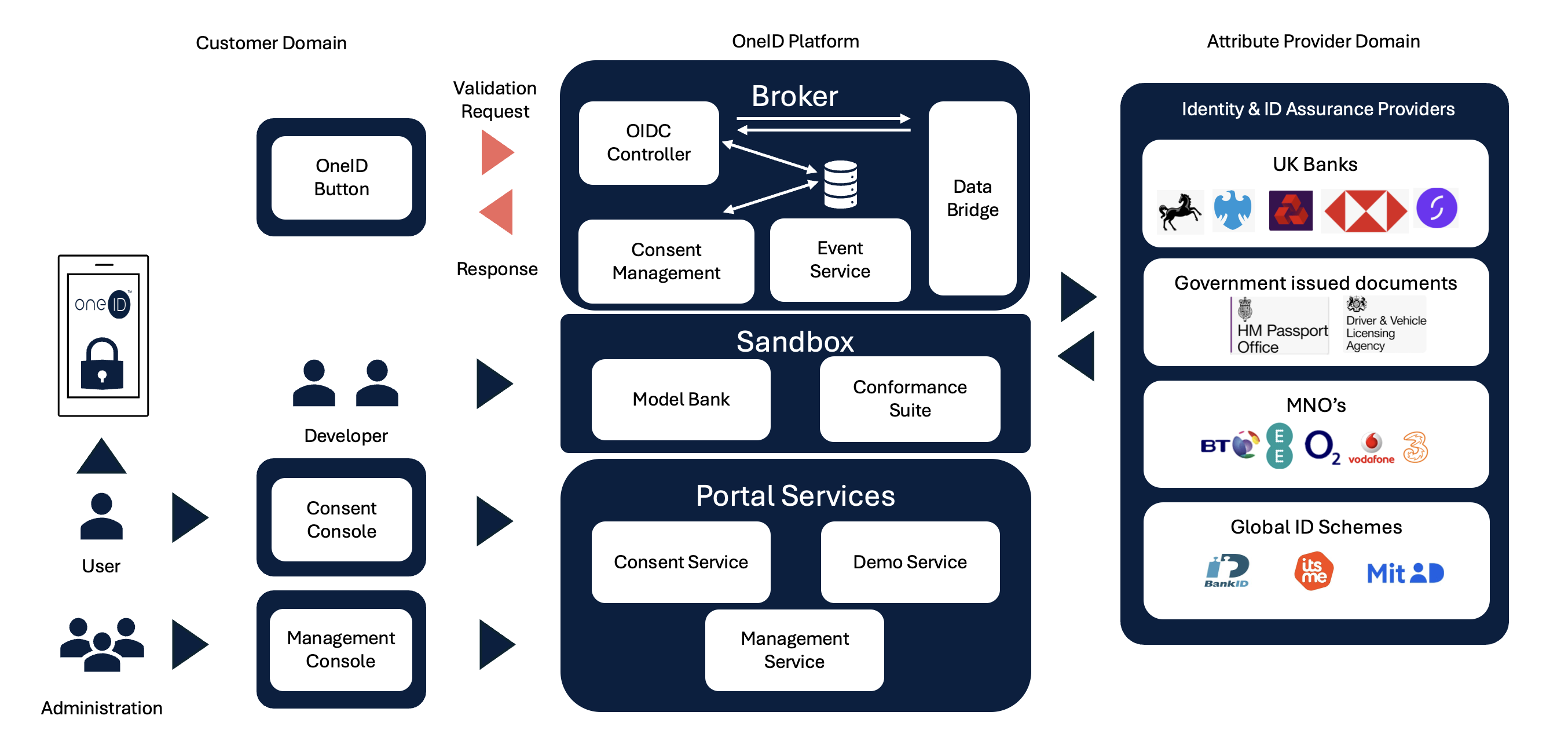

This schematic gives a high-level view of how the service is delivered:

Platform Capabilities Overview

The OneID® verification process uses the OpenID Connect (OIDC) protocol, which is built on the OAuth 2.0 standard. OIDC is a widely adopted protocol used for authentication and identity verification (for example, "Sign in with Google" is powered by OIDC). For more details on OIDC, visit What is OIDC?.

The OneID® platform offers the following features:

- Consent History Access: Easily track and manage consent history.

- OneID® Management Portal: A web-based application providing Relying Parties (RPs) with tailored access to key statistics, such as daily usage counts and bank availability. The portal is also accessible via a RESTful API for integration with other systems.

- Operations & Billing Support: Comprehensive support for operational queries and billing management.

⚒️ How it Works

To verify identity the process is as follows:

- The Relying Party modifies the customer acquisition process to provide the option to prove identity via OneID®.

- The Relying Party redirects the user to OneID® where the user is asked to confirm consent for the transfer of the data fields requested by the Relying Party (e.g., name, address, age) from the bank. If consent is not given, then the journey ends at this point.

- The user then logs onto their bank using the banking app with which they are already familiar.

- Following the protocols defined in OIDC, the OneID® Broker and the bank then exchange various authorisation codes and access tokens and the broker collects the requested data fields.

- If the Relying Party is using the confidential client option, the OneID® broker returns a “OneID® authorisation code” directly to the Relying Parties application. The application can then use that code to request the data fields from the broker.

- The Relying Party application uses the supplied data fields to verify the user’s identity and on-board the customer.

🏦 Connected Banks

| Bank | Account Type Accepted | Account Type Not Accepted |

|---|---|---|

| Allied Irish Bank |

|

|

| Barclays |

|

|

| Bank of Scotland |

|

|

| Chase |

|

|

| Clydesdale Bank |

|

|

| Coutts |

|

|

| Danske |

|

|

| First Direct |

|

|

| Halifax |

|

|

| HSBC |

|

|

| Lloyds |

|

|

| MBNA |

|

|

| Monzo |

|

|

| Nationwide |

|

|

| Natwest |

|

|

| Royal Bank of Scotland |

|

|

| Revolut |

|

|

| Sainsbury's Bank |

|

|

| Santander |

|

|

| Starling |

|

|

| TSB |

|

|

| Ulster |

|

|

| Virgin Money |

|

|

Accepted account types by bank

Individual Savings Accounts (ISAs) can be both cash and investment. Stocks & Shares ISAs and Lifetime ISAs are investment accounts and are therefore not accepted.

🔗 Integration Methods

@Copyright OneID Limited 2024